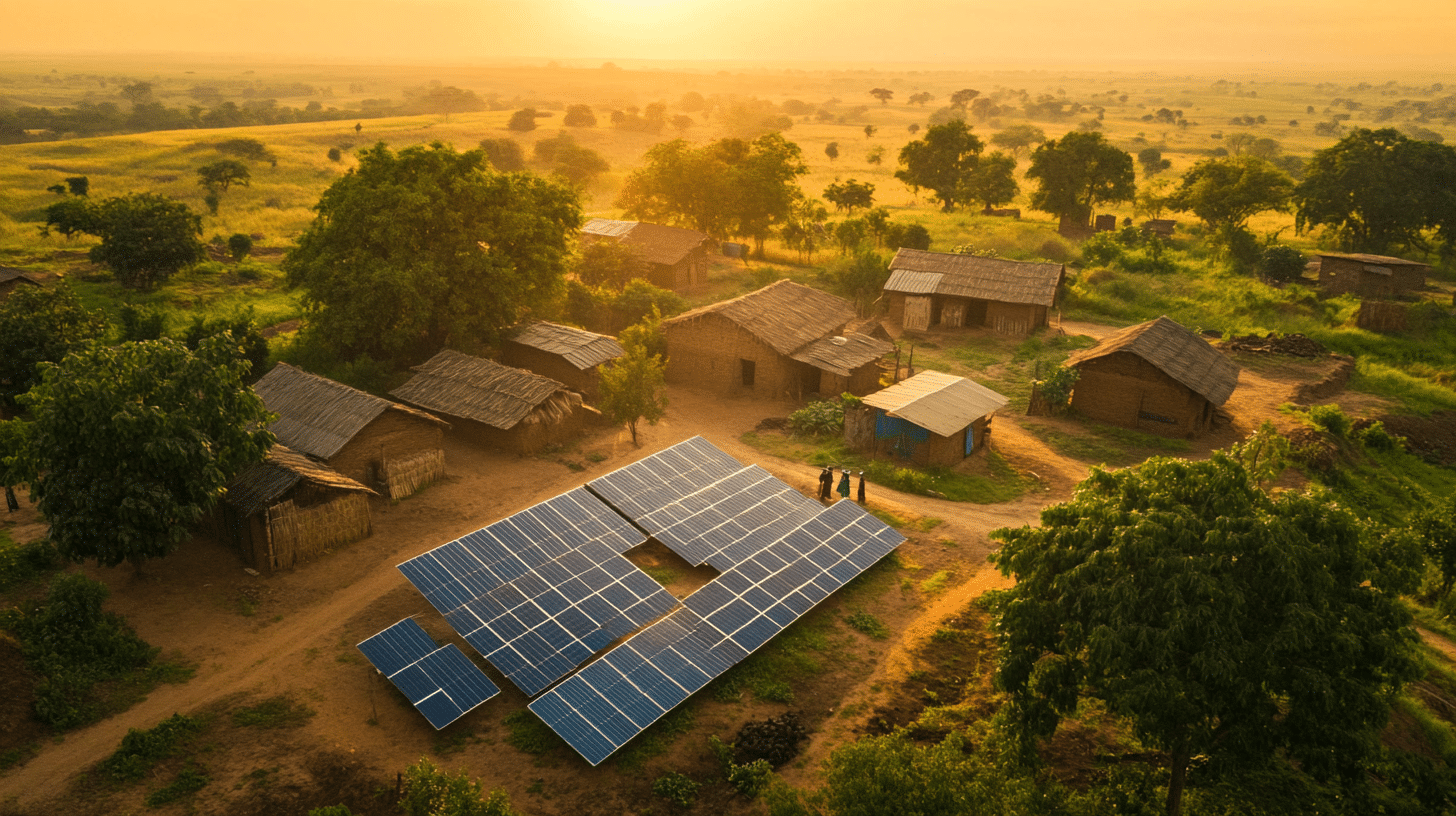

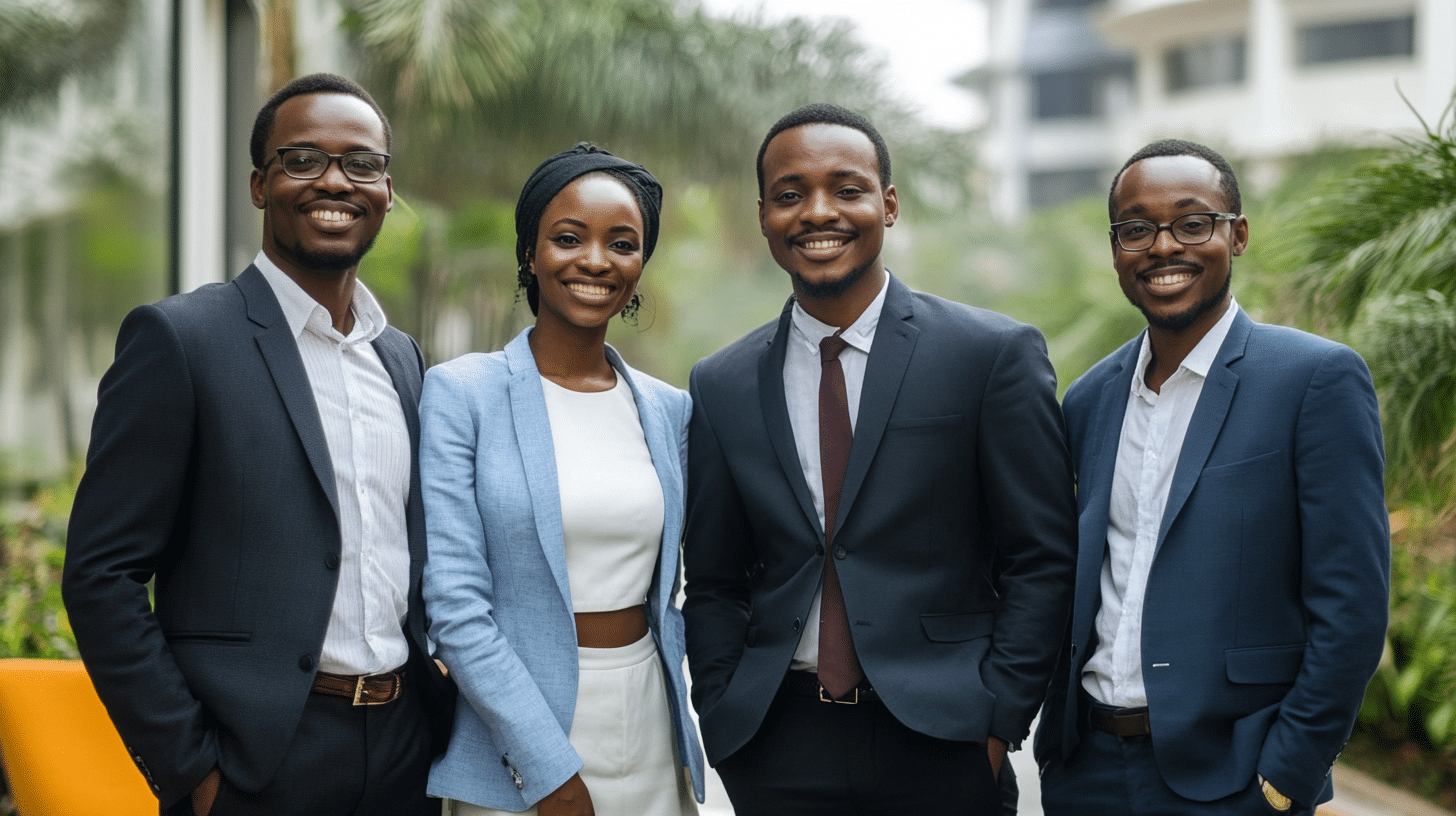

We connect African economies to what they need for sustainable growth: capital, expertise, and technology

At the heart of our uniqueness lies a deep understanding of local realities, diverse skills, and international quality standards

Fundraising Support & Financial Intermediation

We partner with private, public, and non‑profit organizations to design optimal capital structures and secure the local and international financing they need to achieve sustainable growth.

Intensive programs to accelerate and sustain high-impact businesses.

Startup Studio and Creation & Management of Investment Vehicles.

Capital Structuring and Mobilization

Fundraising Support or Financial Intermediation

We help the private, public, and non-profit sectors structure and raise the local and international financing they need to grow

Investor Support

We assist local and international investors in sourcing, evaluating, and investing in high‑potential opportunities across the private, public, and non‑profit sectors.

Acceleration

Our Acceleration Approach

We design sustainable growth pathways for high‑potential SMEs. Each tailor‑made program is a transformative journey, delivering a 360° organizational, technical, and financial upgrade. Our goal is to strengthen impact, enhance resilience, and prepare businesses to attract the necessary investment to scale.

At ForthInvestment, we are convinced that SMEs are key agents of change, capable of addressing major social and environmental challenges.

Our acceleration programs aim to unlock their full potential, by strengthening their structure, leadership, and capacity to grow, while contributing to a resilient and impactful entrepreneurial ecosystem.

Our programs combine inclusive support and structured financing to enable SMEs to become sustainable and access the resources necessary for their growth.

Each program is based on a proven methodology, structured around five complementary pillars:

- Tailor-made support, adapted to each stage of maturity;

- Practical tools aligned with the realities and challenges of SMEs;

- A multidisciplinary team, from ForthInvestment and its technical and financial partners;

- Flexible financing mechanisms adapted to the needs of businesses;

- Post-financing support to ensure the proper use and impact of mobilized funds.

- Our approach reconciles international standards, local roots, and impact requirements.

- Each program is tailor-made, with a deep understanding of the realities of African SMEs, high-level human and technical support, and the direct involvement of committed strategic partners.

Some Programs

Our programs support African entrepreneurs at every stage of their journey, combining expertise, financing and networking to transform their ideas into solid, sustainable, high-impact projects.

Job & Business Booster

Superstar Business Impact

Acceleration program designed to strengthen the organizational capabilities of 10 high-impact companies, to prepare them effectively for their expansion phase.

Jidiiya fund / Orange Corners Innovation fund Mali

High-Performing SMEs WASH/SCALE

Biodigester Support Program

COLAB

Our Financing Solutions

We develop innovative financial mechanisms to improve access to financing for African SMEs.

Startup-studio

Company start-ups

- Supports the creation of startups, from idea to impact

- Finances the launch of projects via a dedicated fund.

- Relies on shared resources and a multidisciplinary team.

- Aims to maximize the impact of startups from their launch.

We develop innovative financial mechanisms to improve access to financing for African SMEs.

Mezzanine debt(ForthCapital): currently being raised ...

A mezzanine debt fund to address poverty by financing and supporting 150 SMEs in the missing middle in French-speaking West Africa